Visit the new L&T Finance Website

Click here| Charges Type | Details |

|---|---|

| Documentation charges | Upto 1 % of the loan amount + applicable taxes |

| Prepayment/Foreclosure charges | 2% of prepaid amount + applicable taxes |

| Valuation charges | As per actuals |

| Late payment interest | 3% per month on overdue EMI |

| Repayment bounce charges | ₹ 1000/- + applicable taxes if any. |

| Legal /Recovery /Repo /Parking & other charges | As per actuals |

| RC Non submission charges | ₹ 1000/- |

| Duplicate NOC charges (Charges is applicable for paper copy post 3 free copies per customer) | ₹ 1000/- + applicable taxes |

| Repayment swap charges (per swap) | ₹ 500/- + applicable taxes (Applicable only for branch walk-ins) |

| SOA/RPS /FC letter & other documents | Nil |

Finance your aspirations today!

APPLY NOWAgri Business Loans For You.

Apply With Ease

Enter KYC Details

Enter Dealer and asset details

Enter Land holding and income details

Get loan sanction & E-Sign

Loan Disbursement

Kisaan Suvidha (Top-Up Loan).

- Setting Up Units

- Purchase of Agriculture Implements

- Horticulture Centre

- Agriculture Insurance

- Personal Use

Use top-up loan funds to set up dairy units /Fisheries or Micro irrigation requirements

Equipment's like Rotavator, Cultivator, Trailer, Trolly, Thresher, Bailer, Harvester are used for various farming operations. Avail a Implement loan to fund purchase of agricultural Implements with Farm Equipment Finance.

To set up a greenhouse, cold storage, or a horticulture centre.

Buy agriculture insurance to protect from crop losses.

Use funds for personal use – Education, Business, Health Emergencies

Our Achievements

Farm Equipment Finance

Farm Equipment Finance

- Tractor Loan Disbursements Up By 15% YoY To ₹ 5,152 Crores.

- Book Value Increased By 10% To ₹ 11,317 Crores.

Empowering Your Goals.

Farm Equipment Finance

Over 2 years have passed since I first took a tractor loan from LTF. The FLS assisted me personally and answered all my EMI & Loan related queries. The loan was disbursed within 24 hours and the money got credited the same day. LTF also provided me with a pre-approved loan considering my good track record, which was extremely beneficial to my business. I would definitely recommend LTF to my friends and family.

Farm Equipment Finance

My friend recommended LTF since they provide tractor loans at a lower interest rate than others, the loan process is simple, no physical documentation is required, payment was deposited the same day and I received the tractor within a week. My agricultural business has really improved thanks to the LTF.

Farm Equipment Loan

L&T Finance was recommended by a friend for a tractor loan. The loan was disbursed immediately and I received my tractor within a few days. The new tractor really helped me to grow my business. I would definitely prefer L&T Finance for future loan requirements.

Frequently Asked Questions

Have more doubts about Farm Equipment Finance? Get all your queries answered here.

1. What Is A Top-Up Loan?

2. What Happens To My Existing Loan?

3. Do I Have To Keep Paying My EMIs Until The Top-Up Amount Is Approved?

4. How Do I Cancel My Top-Up Process?

5. Why Do I Have To Pay Fee For Top Up ?

Share

Explore Other Products

At Your Service.

Reach out to L&T Finance on any device, across multiple channels.

Want a callback? Enter your details.

By proceeding, I confirm that the information provided by me here is accurate. I authorize L&T Finance and/or its authorized representatives to contact me for any queries and/or my documents collection for the loan application. This will override registry on Do Not Disturb (DND)/National Do Not Call (NDNC)

GET A CALLBACK

Know More About PLANET App

If you prefer Self Help Option (SHO) Click here

Corporate Office

Brindavan Building, Plot No 177

Vidyanagari Marg, CST Road,

Kalina, Santacruz (E), Mumbai 400 098

To visit a branch of L&T Finance please Click here

Connect With us on WhatsApp!

Send 'Hi' or 'Hello' to : +91 7378333451

Have more queries?

Get them answered instantly.

Customer Care

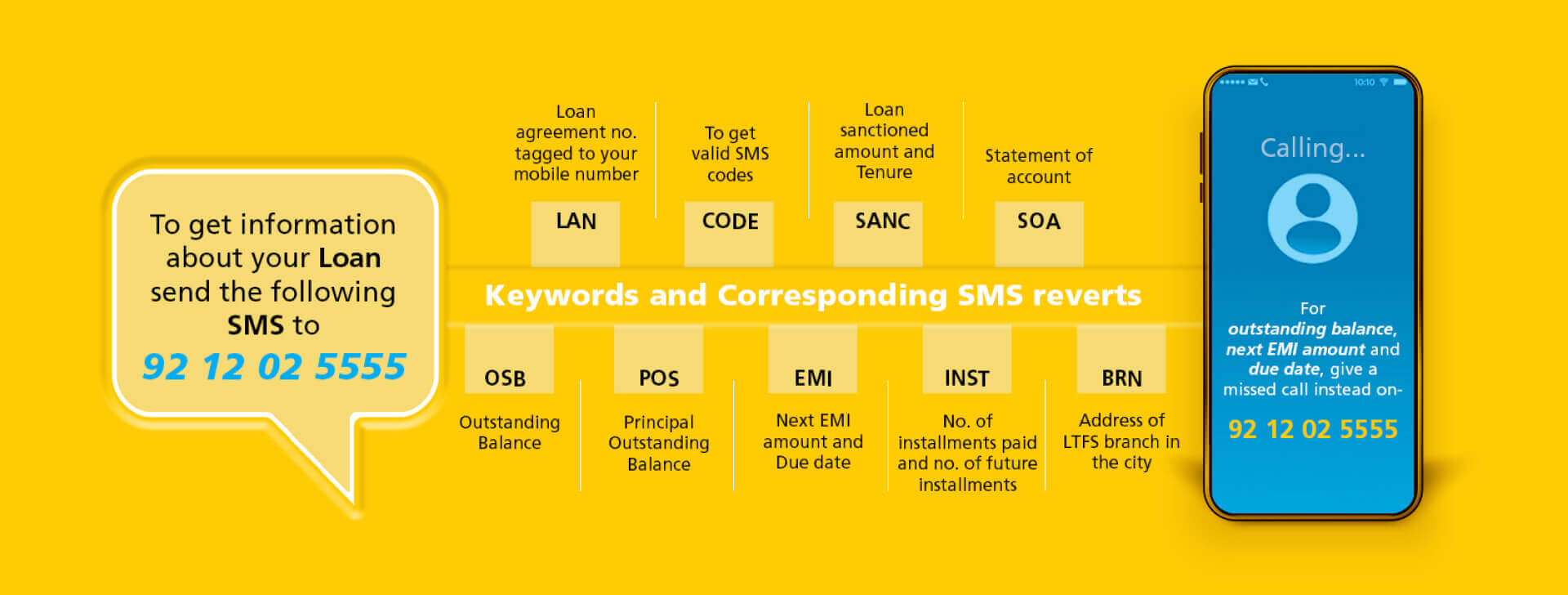

You may Call, SMS or e-Mail us for your loan related needs.

Personal Loans | Two-Wheeler Finance | Farm Equipment Finance | Warehouse Receipting Finance

[email protected] 1800-268-0000All days of the week (Except National Holidays) from 9 AM to 6 PM IST

.png?sfvrsn=8188cada_1)

.png?sfvrsn=dbe84936_1)

-(1).png?sfvrsn=2a4db048_1)