Visit the new L&T Finance Website

Click here

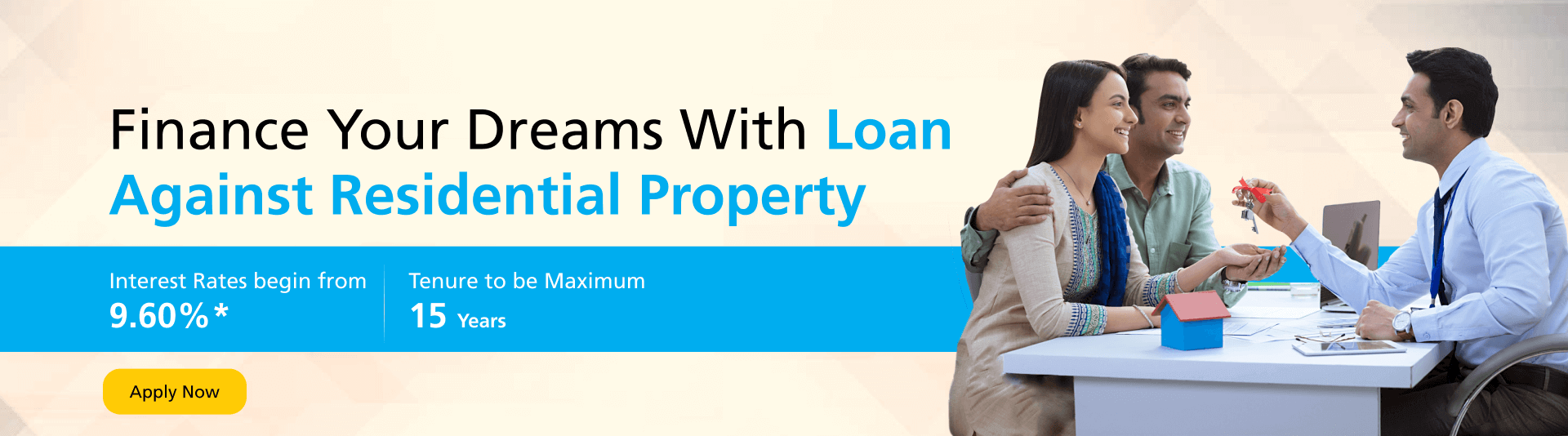

Loan Tenure

Maximum loan tenure of upto 15 years

Maximum Loan Amount

You can avail a loan ranging from ₹25 lacs to ₹7.5 cr

Quick & Efficient Processing

Get funds within 72 hours*

Flexible Repayment Options

Tranche based EMI and Part Prepayment Scheme

Attractive interest rates

Loan Against Property starting at 9.60%* rate of interest

Eligibility

- Salaried Individuals:

• Resident of India

• Age: 23 to 62 years of age

• Salaried employee of any public, private or multi-national organisation - Self-employed individuals:

• Resident of India

• Age: 25 to 70 years of age

• Self-employed individual with a steady income from business

- Salaried Individuals

- Professionals

Self-Employed Professionals (SEP) - Businessman

Self-Employed Non Professionals (SENP)

Salaried Individuals

- Latest salary slips

- Bank account statements of the past 3 months

- PAN card/Form 60 of all applicants

- ID proof

- Address proof

- Document of the property to be mortgaged

- IT returns

- Title documents

Self-employed Individuals

- Primary Bank account statements of the previous 6 months

- PAN card/Form 60 of all applicants

- ID proof

- Address proof

- Income documents like ITR/financial statements

- Document of the property to be mortgaged

- Title documents

Age Proof

- PAN Card

- Aadhar Card

- Income documents like ITR/financial statements

- Document of the property to be mortgaged

- Title documents

Address Proof

- Passport

- Election ID Card

- Utility Bill

- Driving License

- Registered Rent Agreement

- Aadhar Card

Photo ID Proof

- PAN Card

- Aadhar Card

Income Proof

- Latest 2 years ITRs with computation for the individual applicants and co applicants (When borrower is an individual)

- Bank Account Statement (Current and Savings Accounts) required for last 1-year

- Latest 2 years audited / C.A. certified profit & loss accounts and balance sheets of the firm / company (When borrower is a firm / company)

| Charge Type - Loan Against Property | Details |

|---|---|

| Processing Fee | Upto 3% on Sanctioned Amount + applicable taxes |

| Repayment bounce charges | Rs.1,000/- + applicable taxes |

| Late payment interest | 3% per month on overdue EMI |

| Annual Maintenance charges | NA |

| Duplicate NOC charges (Charge is applicable for paper copy post 3 free copies per customer) | Rs 250/- + applicable taxes |

| Repayment swap charges ( per swap) | Rs 500/- + applicable taxes |

| Additional documents charges -SOA/RPS/FC letter /Interest Certificate | Nil |

| Valuation Charges | As per actuals |

| Documentation Charge | As per actuals |

| Cash pickup charge | Nil |

| Interest Rate Conversion Charge | Rs. 1,000 + GST |

| List of documents | Rs. 300/- +applicable taxes |

| Providing Photo copies of the documents | Rs. 500/- +applicable taxes |

| Charges incurred by LTFL for initiating action under Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act 2002 | · Issue of Loan Recall Notice = Rs. 500/ – · Issue of Demand Notice = Rs. 1,000/ – · Issue of Possession Notice = Rs. 2,000/ – · Applying District Magistrate Order = Rs. 8,000/ – · Taking Physical possession = Rs. 20,000/ – Actual cost incurred will be debited for expenses pertaining to Publication of Possession Notice / Publication Demand Notice / Publication of Sale cum Auction Notice. |

| Legal / Recovery Charges (Other than pertaining to SARFAESI) | As per actuals |

| Loan Cancellation Charges | Rs. 5000/- + applicable taxes |

| Recovery of proportionate actual expenses from disbursement date(s), from individual borrower(s) in | LAP – Upto 1% of total disbursed loan amount + applicable taxes in case of closure within 24 months |

| Foreclosure / Full prepayment Charges – Loan Against Property | For Individual Borrowers – • Floating Rate – Nil Charges where end use is not for business/commercial purpose • Floating Rate – for cases where end use is for business/commercial purpose • Less than 1 year from disbursement – upto 3% on principal outstanding + applicable taxes • Post 1 year of disbursement – upto 2% on principal outstanding + applicable taxes • Fixed Rate – • Less than 1 year from disbursement – upto 4% principal outstanding + applicable taxes • Post 1 year of disbursement – upto 3% on principal outstanding + applicable taxes For Non – Individual Borrowers – (Applicant/Co – applicant) • Fixed/Floating rate loan – • Less than 1 year from disbursement – upto 4% principal outstanding + applicable taxes • Post 1 year of disbursement – upto 3% on principal outstanding + applicable taxes |

| Pre-payment Charges – Loan Against Property | For Individual Borrowers – • Floating Rate – Nil Charges where end use is not for business/commercial purpose • Floating Rate – for cases where end use is for business/commercial purpose • Less than 1 year from disbursement – upto 3% on Partial / Pre – payment amount + applicable taxes • Post 1 year of disbursement – upto 2% on Partial / Pre – payment amount + applicable taxes • Fixed Rate – • Less than 1 year from disbursement – upto 4% on Partial / Pre – payment amount + applicable taxes • Post 1 year of disbursement – upto 3% on Partial / Pre – payment amount + applicable taxes For Non – Individual Borrowers – (Applicant/Co – applicant) • Fixed/Floating rate loan – • Less than 1 year from disbursement – upto 4% on Partial / Pre – payment amount + applicable taxes • Post 1 year of disbursement – upto 3% on Partial / Pre – payment amount + applicable taxes |

| Charge Type - LAP - Dropline Overdraft and Hybrid Overdraft Facility | Details |

|---|---|

| Additional Interest | 2 % p.m. on overdue amounts |

| Payment Mandate Dishonour Charges | Rs.500/- |

| Foreclosure / Full Pre-payment charges | 5 % on outstanding Loan on the date of such full pre-payment |

| Part Pre-payment charges | Dropline / Hybrid Overdraft: • Not allowed till the day after the First Due Date. No charges applicable from the day after the First Due Date. • Part pre-payment of Loan toward limit reduction is not available |

| Annual Maintenance Charges (applicable only for Dropline Overdraft and Hybrid Overdraft) | 0.25% (+GST) of the Loan Amount as per the Repayment Schedule |

| Legal / Recovery Charges | Actual |

| Statement of account/ Repayment Schedule/ no dues certificate/ interest certificate | Physical copy at a charge of Rs.500/- +GST per statement/letter/certificate. Digital is NIL |

| Mandate Swap Charges | Rs.500/- + GST |

| Breakup between Principal & Interest | As per Repayment Schedule |

| Example of SMA/ NPA classification | More particularly mentioned under “Classification of Assets” under the head “Miscellaneous” |

Get your ambitions financed today!

APPLY NOWLoan Against Residential Property

- Lower Interest Rate

- Purchase Residential Properties

- Top-Up Loan

- Buying a home can be quite tempting initially. And later on, the interest on your loan could be a burden for you. Now with Balance Transfer to L&T Finance Housing Finance, home buyers can transfer your existing loan from any other financial institution to help you save on interest expenses.

- While you can take a home loan for many other types of properties, a balance transfer is applicable only on residential properties. If you wish to reduce your interest expenses on your existing loan from any other financial institution, you can opt for Balance Transfer with L&T Finance.

- Need a little more to offset your home loan expenses? Balance Transfer allows you to get a Top-Up Loan that can both, allow you to pay a lower interest as well as take care of additional expenses.

- Got your sights set on an attractive piece of land? Now you can use our home loan facility to buy an everlasting asset.

- Starting at an interest rate of 7.95%, a home loan could help immensely with construction and expansion of a home.

Explore More

Empowering Your Goals.

Housing Loan

I feel immensely grateful for your active cooperation and your cooperation has been outstanding and commendable. Without your contribution, it would be difficult for me to get my loan pass in a short period. Thank you for your untiring efforts and diligent work. Hats off for your support and guidance.

Housing Loan

It was indeed great to be associated with L&T Finance, the sales team here is very supportive and committed. Services provided are beyond delight and it was a pleasure interacting with them. The process of my home loan application was very simple and easy and the overall process was smooth.

Our Achievements

Home Loan And LAP

Home Loan And LAP

- Disbursements at ₹2,399 Cr in FY22

- Home Loan Approval (login to sanction): 20 minutes against industry average of 2 days

Share

Frequently Asked Questions

Have more doubts about home loans? Get all your queries answered here.

1. What are the different types of Loan Against Property provided by LTHFL?

2. How will LTHF decide my LAP eligibility?

3. What are the eligibility conditions for LAP?

4. How can I increase my eligibility?

5. Who can be a co-applicant?

6. What is the processing time of loan?

7. What is an EMI?

8. Kindly advice the best option for paying EMI ?

9. Will my tenure change or there is a change in the EMI if there is change in ROI?

10. In case of change of EMI, what is my revised EMI amount?

11. What is pre-EMI interest?

12. When do I pay PEMI?

13. What is the age criteria?

14. What is the maximum or minimum loan amount that LTHF funds?

15. What is the work experience criteria?

16. What is the limit on tenor of loan?

17. What are the LTV norms?

18. Can I repay my loan ahead of schedule?

19. How frequently can I repay my loan ahead of schedule?

20. What security will I have to provide?

21. Does the Property have to be insured?

22. Does the Agreement for Sale have to be registered?

23. Are there any restrictions on transfer of immovable properties?

24. Can I get an additional Loan on my existing Loan account?

25. How much loan can I get as Top Up loan?

26. How does the floating rate change?

27. Where will I get my provisional/final Interest certificate?

28. Are there any part prepayment charges?

29. How much is the processing fee?

30. Can I start paying my EMI in case my loan is partly disbursed?

31. What is repayment tenure?

32. While borrowing a Home Loan what are the questions that need to be clarified specially in the context of fixed and floating loans?

33. Can I convert my floating rate loan to fixed rate loan or vice versa?

34. Will my interest rate change in future?

35. What is the minimum part prepayment amount that I need to pay?

36. What is the tax benefit against my loan?

37. What is the rate at which I will get Top Up loan?

At Your Service.

Reach out to L&T Finance on any device, across multiple channels.

Want a callback? Enter your details.

By proceeding, I confirm that the information provided by me here is accurate. I authorize L&T Finance and/or its authorized representatives to contact me for any queries and/or my documents collection for the loan application. This will override registry on Do Not Disturb (DND)/National Do Not Call (NDNC)

GET A CALLBACK

Know More About PLANET App

If you prefer Self Help Option (SHO) Click here

Corporate Office

Brindavan Building, Plot No 177

Vidyanagari Marg, CST Road,

Kalina, Santacruz (E), Mumbai 400 098

To visit a branch of L&T Finance please Click here

Connect With us on WhatsApp!

Send 'Hi' or 'Hello' to : +91 7378333451

Have more queries?

Get them answered instantly.

Customer Care

You may Call, SMS or e-Mail us for your loan related needs.

Personal Loans | Two-Wheeler Finance | Farm Equipment Finance | Warehouse Receipting Finance

[email protected] 1800-268-0000All days of the week (Except National Holidays) from 9 AM to 6 PM IST

.jpg?sfvrsn=ad8e7f11_1)