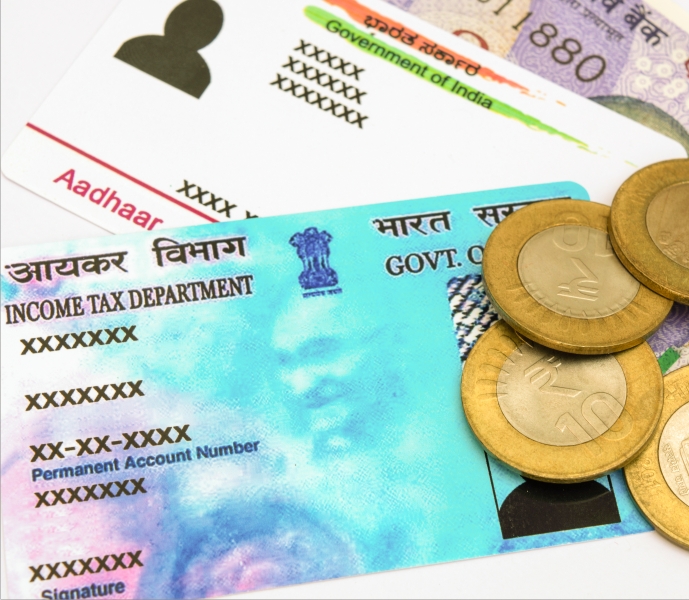

The Income Tax Department has made PAN Aadhaar link mandatory under Section 139AA of the Income Tax Act, 1961, with a view to ease financial transactions and curb tax evasion. Apart from this, such linking might also be useful in keeping a check on fake PAN cards used for black money and money laundering cases. Here are a few essential things you must know about why and how to link your PAN with Aadhaar.

What are PAN Card and Aadhaar Card?

The Income Tax Department issues the PAN or Permanent Account Number, a 10-digit unique alpha-numeric identity, to all categories of taxpayers including individuals in India. An Aadhaar Card, on the other hand, is a 12-digit random number issued to Indian residents by the Unique Identification Authority of India. Both PAN Card and Aadhaar Card are critical identity documents that can be used for government and official purposes.

About Mandatory PAN-Aadhaar linking

The Central Board of Direct Taxes had announced that individual taxpayers must link their PAN with Aadhaar before 30 June 2023. The taxpayers can still link their PAN with Aadhaar on fee payment of Rs. 1000 after 1 July 2023 & onwards

Linking PAN with Aadhaar helps the Income Tax department to identify tax evasions, identify fake PAN cards used for black money, reduce frauds and increase the revenue base. Further, it will also be easier to identify multiple or duplicate PAN / Aadhaar Cards.

Why is PAN-Aadhaar linking Aadhaar important

Not linking your PAN with Aadhaar will make your PAN Card inoperative. This will lead to some harsh consequences:

● Unlinked PAN Cards will not receive tax refunds

● Financial and banking transactions will be restricted

● ITR filing will be restricted

● Higher Tax deducted at source (TDS) or Tax collected at source (TCS)

How to Link PAN Card with Aadhaar Card?

Even if you missed the deadline for linking PAN with Aadhaar , you still have a chance to link it . All you have to do is - Pay Rs. 1000 via the e-filing website of the IT department, then submit a linking request, and finally check the linking status of your PAN with Aadhaar online.

Here’s a step-by-step guide to complete the online linking process:

● Go to the official website of the Indian IT department: https://www.incometax.gov.in/iec/foportal/

● In the Quick Links section, click on Link Aadhaar

● Enter your PAN Card and Aadhaar Card numbers

● Click on Continue to Pay Through e-Pay Tax

● Pay Rs. 1000 and provide your PAN and Assessment Year details

● If the payment is successful, go to the e-filing portal’s homepage

● Under Quick Links, click on Link Aadhaar

● Provide your PAN and Aadhaar Card numbers

● Then, click Validate

● Enter the required mandatory details

● Then, click on Link Aadhaar

● You will get a 6-digit OTP on the provided mobile number

● Enter the 6-digit OTP

● Then, click on Validate

● After this, your screen will display a message - REQUEST FOR LINK OF AADHAAR HAS BEEN SUBMITTED SUCCESSFULLY

● Check PAN Aadhaar linking status for successful completion